I know this is going to sound crazy, but here goes. If there was one thing I could change when dealing with first time investors it would be their over whelming focus on the property.

Now before you pillory me and dismiss my pearls of wisdom let me explain. The key word in the phrase “Property Investment” is “INVESTMENT”. The property part is merely the vehicle to achieve a positive outcome. Lets look at that key word, investment.

Investment as defined by the Oxford dictionary: noun

the act of putting money, effort, time, etc. into something to make a profit or get an advantage.

Financial Investments can come in many forms, cash, art, wine, gold, shares, property. So why do we, as a society, gravitate so heavily towards property?

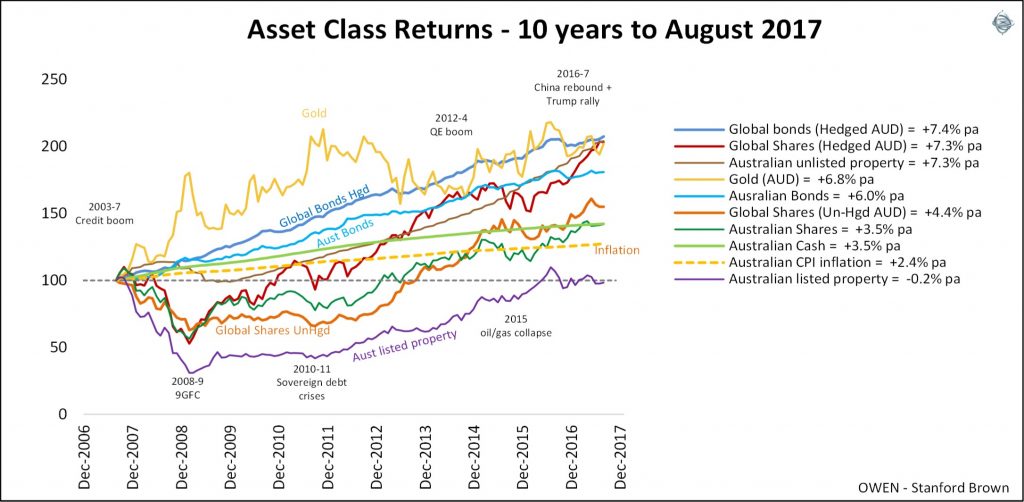

Well for one, its very physical. You can see it, touch it, walk around/through it. However more importantly, it has been shown time and time again to provide consistent returns on investment. Lets look at some traditional investments over a 10 year period:

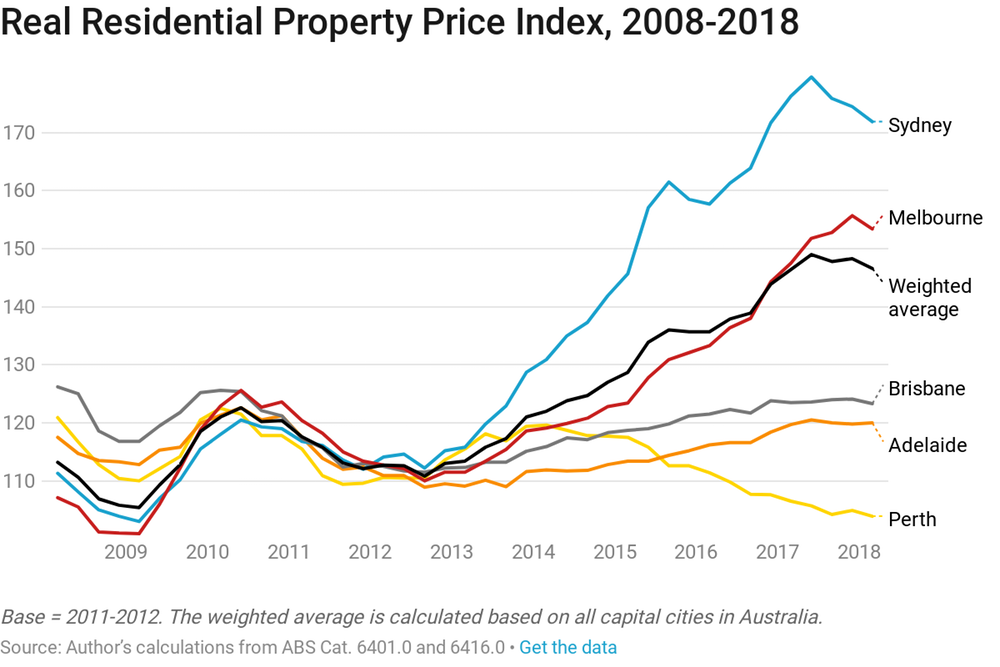

The key takeaway from the above graph is Australian Shares +3.5%, Australian unlisted property +7.3%. Now don’t forget, that’s growth and doesn’t include dividends and rental returns or tax imputations. But what about 2018, didn’t we see negative returns there? Lets check:

So yes, as we can see there was a small correction in the past 12 months. But consider this, in 2008 the median house price in Melbourne was $460,827 and grew by 98.5% to $914,518 in Q1 2018 (source Domain Group data). The ASX finished the ’07/’08 year at 5355, today it sits at 5630, or an increase of less than 5.5%.

So now we know why property, but as I alluded to in my opening comments, the actual property is the last piece of the puzzle. First we need to understand where you are now financially, where you want to get to, what leverage or equity do you have & how much time do you have. Once we understand this, we can then decide upon the correct strategy and what type of asset will deliver to the strategy. The last piece of the puzzle is going out and sourcing that asset.

If you wish to learn more about how I can assist you with your next investment decision check out my strategy page to see how I operate, or just complete the form below and I will contact you within 24 hours for a no obligation chat.